Why a Secured Credit Card Singapore Is Necessary for Building Your Credit Report

Why a Secured Credit Card Singapore Is Necessary for Building Your Credit Report

Blog Article

Introducing the Opportunity: Can Individuals Released From Personal Bankruptcy Acquire Credit History Cards?

Understanding the Impact of Insolvency

Bankruptcy can have an extensive effect on one's credit rating, making it testing to access credit report or finances in the future. This financial stain can remain on credit scores records for numerous years, impacting the person's ability to secure favorable passion rates or monetary opportunities.

Additionally, bankruptcy can restrict job opportunity, as some companies conduct debt checks as part of the hiring process. This can present an obstacle to people looking for brand-new work prospects or profession improvements. Generally, the influence of bankruptcy extends beyond financial restrictions, influencing numerous facets of a person's life.

Aspects Influencing Bank Card Approval

Following bankruptcy, individuals commonly have a reduced credit scores rating due to the adverse influence of the personal bankruptcy declaring. Credit scores card business normally look for a credit history rating that shows the candidate's ability to handle credit scores responsibly. By thoroughly taking into consideration these elements and taking actions to reconstruct credit report post-bankruptcy, individuals can improve their potential customers of getting a credit history card and functioning in the direction of economic recuperation.

Actions to Reconstruct Credit History After Bankruptcy

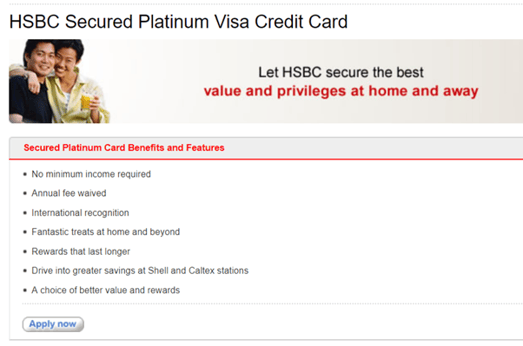

Rebuilding credit history after bankruptcy requires a critical method focused on monetary discipline and regular debt administration. The initial step is to evaluate your debt report to make certain all financial debts consisted of in the insolvency are precisely reflected. It is necessary to develop a budget that prioritizes debt payment and living within your means. One reliable technique is to obtain a guaranteed bank card, where you transfer a particular quantity as security to establish a credit line. Timely payments on this card can demonstrate responsible credit report usage to prospective lending institutions. Furthermore, take into consideration ending up being an accredited customer on a family member's charge card or checking out credit-builder lendings to more enhance your credit rating. It is critical to make all settlements on time, as settlement background considerably influences your credit rating score. Perseverance and perseverance are essential as reconstructing credit report requires time, however with commitment to seem economic techniques, it is possible to boost your credit reliability post-bankruptcy.

Guaranteed Vs. Unsecured Credit Score Cards

Complying with bankruptcy, individuals usually take into consideration the selection in between protected and unsecured credit history cards as they aim to rebuild their creditworthiness and financial security. Safe credit score cards call for a cash deposit that offers as collateral, usually equal to the credit rating limitation provided. Ultimately, the selection between secured and unsecured debt cards should line up with the individual's economic purposes and capacity to manage credit properly.

Resources for Individuals Looking For Credit Scores Restoring

One important resource for people seeking credit history restoring is you could try these out credit report therapy agencies. By working with a credit therapist, people can get understandings into their credit report reports, discover techniques to increase their credit score scores, and receive assistance on managing their funds properly.

An additional helpful source is credit scores tracking solutions. These services enable people to keep a close eye on their debt records, track any type of adjustments or inaccuracies, and spot prospective indications of identity theft. By monitoring i thought about this their credit report routinely, people can proactively deal with any type of issues that may occur and make certain that their credit info is up to date and precise.

Furthermore, online devices and sources such as credit report score simulators, budgeting applications, and monetary literacy internet sites can provide people with important details and devices to assist them in their credit history rebuilding journey. secured credit card singapore. By leveraging these sources efficiently, people released from bankruptcy can take significant actions towards enhancing their credit scores wellness and securing a much better economic future

Conclusion

In conclusion, people discharged from personal bankruptcy may have the chance to get credit cards by taking actions to restore their debt. Factors such as credit score history, debt-to-income, and earnings proportion play a significant function in charge card authorization. By understanding the impact of insolvency, picking between safeguarded and unprotected credit history cards, and using resources for credit scores rebuilding, individuals can improve their creditworthiness and potentially get accessibility to charge card.

By functioning with a credit report therapist, individuals can gain understandings right into their credit report reports, learn strategies to enhance their credit rating ratings, and get assistance on managing their funds efficiently. - secured credit card singapore

Report this page